Post by Deleted on Oct 8, 2019 17:37:01 GMT -5

I've been saying this for a while, but now the data is there to back it up...

A new article in Forbes analyzing data presented in a conference at NYCC led by ICv2 highlights the shifting trends in buying patterns among comics and trades.

article by Rob Salkowitz

-M

A new article in Forbes analyzing data presented in a conference at NYCC led by ICv2 highlights the shifting trends in buying patterns among comics and trades.

article by Rob Salkowitz

A day after New York Comic Con put an exclamation mark on the media dominance that superheroes exert over today’s entertainment and popular culture, data was shared in a private industry conference indicating that a massive shift in the comics publishing industry has reached a tipping point. For the first time that anyone can remember, superheroes are being outsold in their native medium – American comic books and graphic novels – by other kinds of content, notably kid-oriented fare and Japanese (or Japanese-inspired) manga.

The sales trends behind this shift were laid out by longtime industry analyst Milton Griepp at a conference organized by his company ICv2 (disclosure: I am a contributor to ICv2 and participated in the conference), held at Pace University in downtown New York. ICv2, in conjunction with metrics site Comichron, gathers market data on the North American comics industry, tracking sales of periodicals, trade books (aka “graphic novels,”) and download-to-own digital comics.

Sizing the market for comics has become a complicated process. After comic books vanished from newsstands in the early 1980s, nearly all periodical comic books were sold through a network of independently-owned retail comic shops. The comics are distributed through a single firm, Diamond, in an arrangement known as the “direct market.” Because this inventory is non-returnable, the number of copies ordered and shipped to comic stores are counted as sales, even if they do not sell through to customers at retail.

Graphic novels are sold in the direct market and also to trade book stores, with consumer sales tracked through the book industry standard system Bookscan, now owned and managed by media metrics firm The NPD Group. Together, about 90% of comics and graphic novels in North America are sold through book stores or comic stores, with 9% going through digital services like Amazon’s Kindle or the Amazon-owned comiXology, and about 1% sold on newsstands or through Kickstarter.

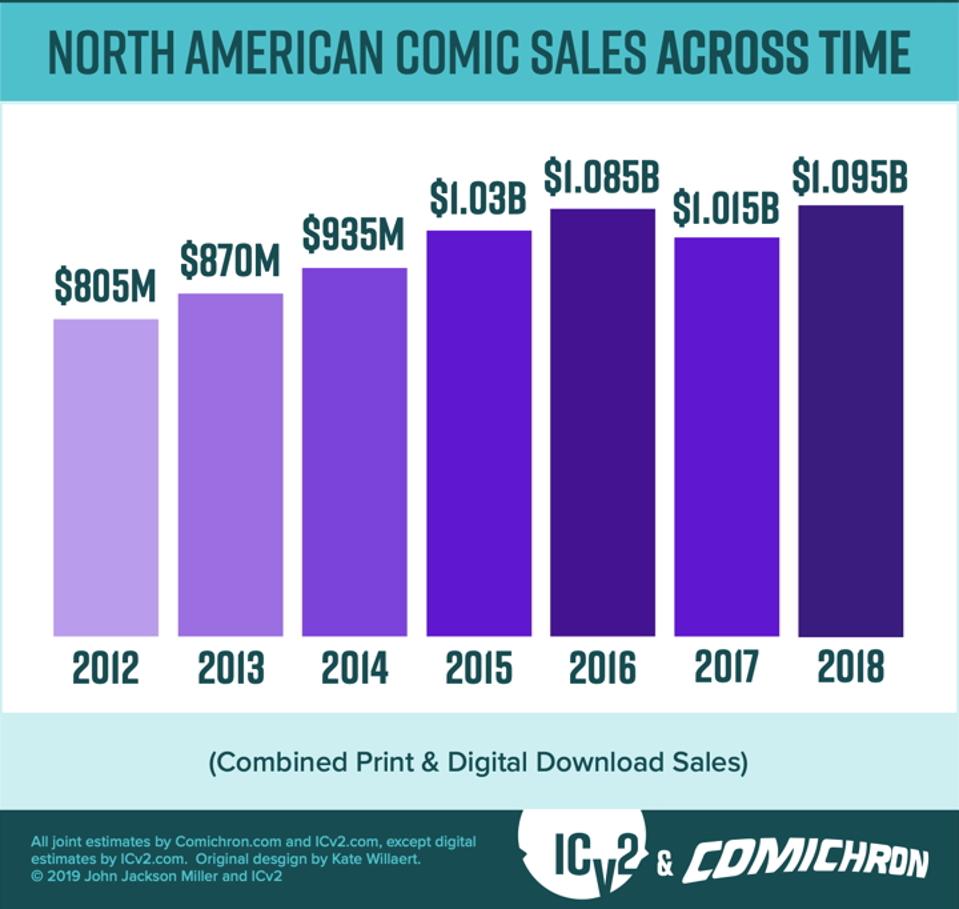

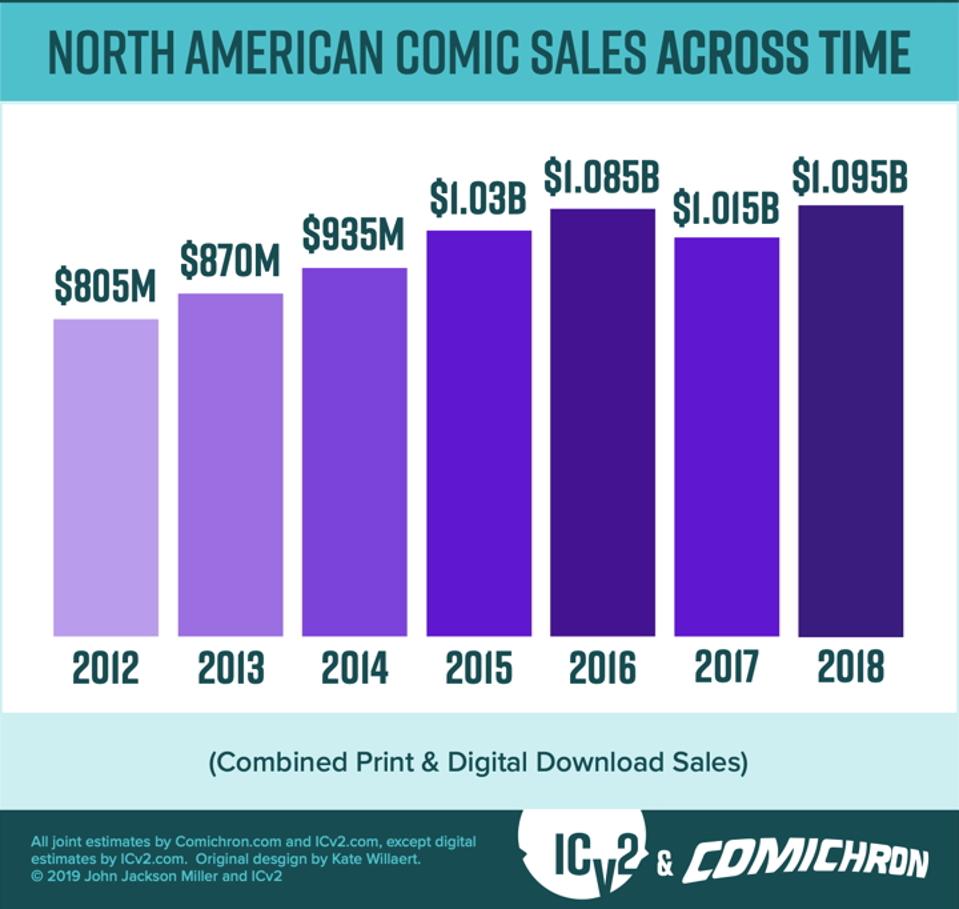

ICv2 has estimated the total value of this market at $1.095 billion in the US and Canada in 2018, up modestly from 2017’s $1.015 billion.

The sales trends behind this shift were laid out by longtime industry analyst Milton Griepp at a conference organized by his company ICv2 (disclosure: I am a contributor to ICv2 and participated in the conference), held at Pace University in downtown New York. ICv2, in conjunction with metrics site Comichron, gathers market data on the North American comics industry, tracking sales of periodicals, trade books (aka “graphic novels,”) and download-to-own digital comics.

Sizing the market for comics has become a complicated process. After comic books vanished from newsstands in the early 1980s, nearly all periodical comic books were sold through a network of independently-owned retail comic shops. The comics are distributed through a single firm, Diamond, in an arrangement known as the “direct market.” Because this inventory is non-returnable, the number of copies ordered and shipped to comic stores are counted as sales, even if they do not sell through to customers at retail.

Graphic novels are sold in the direct market and also to trade book stores, with consumer sales tracked through the book industry standard system Bookscan, now owned and managed by media metrics firm The NPD Group. Together, about 90% of comics and graphic novels in North America are sold through book stores or comic stores, with 9% going through digital services like Amazon’s Kindle or the Amazon-owned comiXology, and about 1% sold on newsstands or through Kickstarter.

ICv2 has estimated the total value of this market at $1.095 billion in the US and Canada in 2018, up modestly from 2017’s $1.015 billion.

Typically, increases in the overall market are driven by the comic industry’s two largest companies, Marvel (owned by Disney), and DC (a part of AT&T’s WarnerMedia group), which both publish corporate-owned superhero comics almost exclusively and together account for about 80% of all comics sold through the direct market.

But for the last several years, the trade book channel has become an increasingly significant driver of revenue, gaining double-digit year over year increases as comic store sales have declined. ICv2 estimates that bookstore sales accounted for $465M in 2018, compared to $510M in the direct market. When you add in the digital and other channels, direct market sales fell under 50% of the total for the first time since comic shops overtook newsstand distribution in the early 1980s.

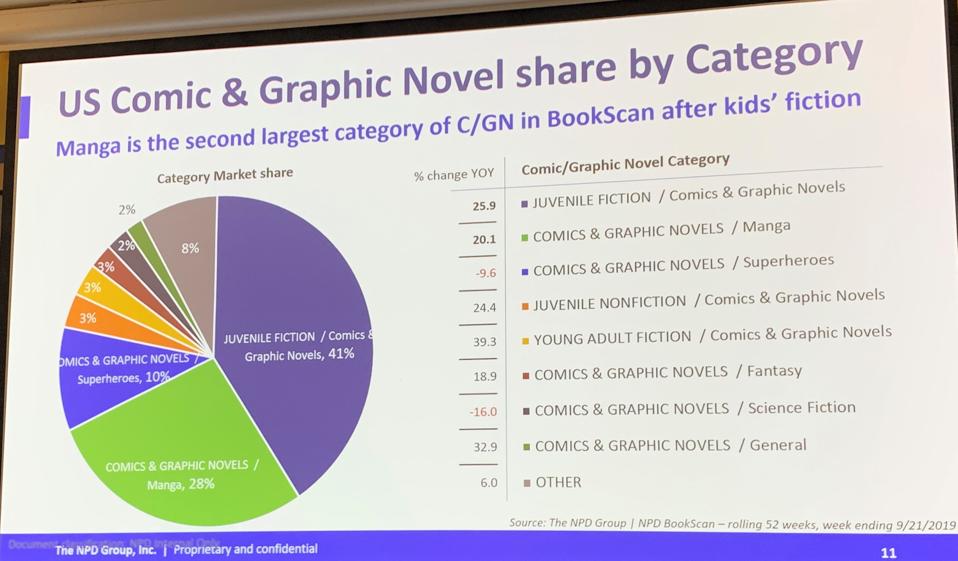

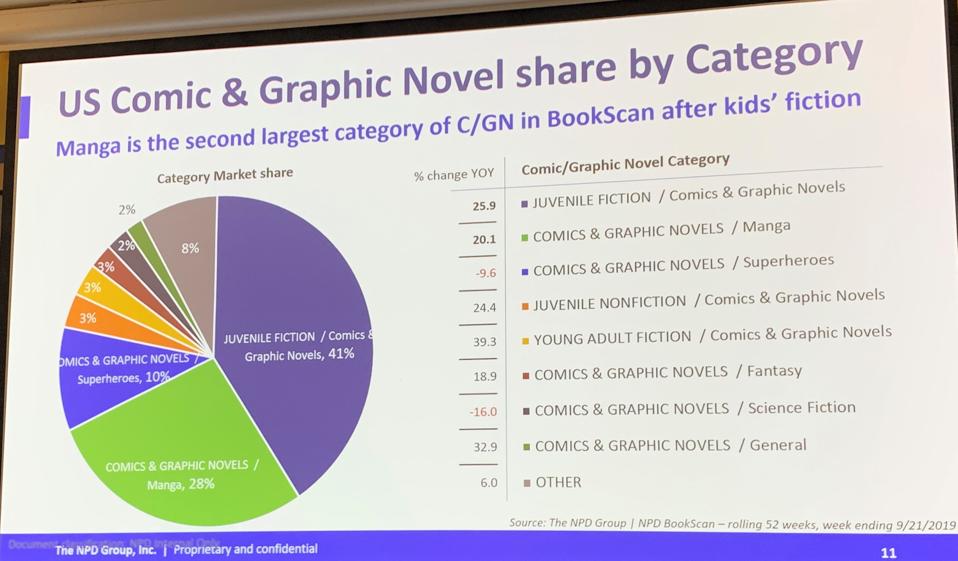

While comic shops tend to focus on longtime fans - often older readers who grew up on and collect superhero comics – mass-market bookstores sell to everyone, including younger readers and those outside of traditional comics fandom. Consequently, the books that are selling in bookstores are, generally, not superhero-oriented. According to Bookscan data shared at the conference, kid-oriented comics and graphic novels account for a whopping 41% of sell-through at bookstores; manga is 28%. Superhero content is less than 10%, down 9.6% year-over-year.

But for the last several years, the trade book channel has become an increasingly significant driver of revenue, gaining double-digit year over year increases as comic store sales have declined. ICv2 estimates that bookstore sales accounted for $465M in 2018, compared to $510M in the direct market. When you add in the digital and other channels, direct market sales fell under 50% of the total for the first time since comic shops overtook newsstand distribution in the early 1980s.

While comic shops tend to focus on longtime fans - often older readers who grew up on and collect superhero comics – mass-market bookstores sell to everyone, including younger readers and those outside of traditional comics fandom. Consequently, the books that are selling in bookstores are, generally, not superhero-oriented. According to Bookscan data shared at the conference, kid-oriented comics and graphic novels account for a whopping 41% of sell-through at bookstores; manga is 28%. Superhero content is less than 10%, down 9.6% year-over-year.

That trend away from capes and cowls is also starting to be reflected even within the more insular comic store market with the arrival of a more diverse audience with different tastes. ICv2 notes a massive shift in the past two years, with kid-oriented titles for readers age 6-18 up 20% in comic store sales and 39% in bookstores, manga up 41% in comics stores and 5% in bookstores, while superhero graphic novels (typically collections of previously-issued periodicals) fell 10% in bookstores and 15% in comic shops.

Though full-year 2019 data is not yet available, it’s clear that the popularity of younger-reader material has accelerated with the unprecedented success of Dav Pilkey’s latest Dog Man graphic novel (initial print run: 5 million) and YA graphic novelist Raina Telgemeier’s latest, Guts, rocketing to the top of the overall best seller list in its first week of release.

Meanwhile, despite the media dominance of superheroes on every screen, the superhero side of the publishing business has been mired in a slump, outside of a few isolated successes like Marvel’s new X-Men relaunch, sporadic DC releases like Doomsday Clock and landmark issues of long-running series.

As Griepp pointed out in his presentation, the sales of superhero-oriented trade books generally follow the trends of periodicals by about 12-18 months (the usual time it takes for publishers to issue collected editions of recent storylines), so those numbers are likely to be even worse when 2019 data is tabulated. Superhero-adjacent genres like horror and science fiction also saw a slump in trade sales with the declining popularity of longtime best-seller The Walking Dead and the breakout series Saga on a publishing hiatus.

Meanwhile, sales of Asian-style manga – already one of the decade’s fastest-growing content categories – have benefited from the availability of animated series on streaming networks like Hulu and Netflix. Another presenter at the conference, NPD Executive Director of Business Development Kristen McLean, shared data showing a clear correlation between binge-watching of popular anime series and subsequent purchase of related manga content.

When you put all that together, it paints a stark picture. Superheroes represent a declining share of the fastest-growing segments and channels of the comics market. They still dominate in single-issue sales in comic shops, but both single issues as a format and comic shops as a channel represent a much smaller and shrinking share of the overall market than has been the case in years’ past.

Disney and AT&T are probably not losing too much sleep over this. The worldwide box office of a single, average-grossing superhero blockbuster feature is as large as the entire comics publishing industry, and the profits on mega-hits like Avengers: Endgame or Joker can buy and sell the entire book and periodical market several times over. Genre comic creators will see a bigger paycheck from an unexercised media option than they will from a best-selling comic book, and most artists on popular titles can earn more on commissions and sales of originals than they’ll get in royalties from reprints and trade collections.

Nevertheless, superheroes have been the dominant genre in American comics since the 1960s and are still the first thing a lot of people think of when they think of comics. Now that’s changing, the culmination of a decade-long market trend and a demographic shift in the audience for graphic literature. The change may not be obvious in the media culture for a while, but it’s coming soon to a bookshelf near you.

Though full-year 2019 data is not yet available, it’s clear that the popularity of younger-reader material has accelerated with the unprecedented success of Dav Pilkey’s latest Dog Man graphic novel (initial print run: 5 million) and YA graphic novelist Raina Telgemeier’s latest, Guts, rocketing to the top of the overall best seller list in its first week of release.

Meanwhile, despite the media dominance of superheroes on every screen, the superhero side of the publishing business has been mired in a slump, outside of a few isolated successes like Marvel’s new X-Men relaunch, sporadic DC releases like Doomsday Clock and landmark issues of long-running series.

As Griepp pointed out in his presentation, the sales of superhero-oriented trade books generally follow the trends of periodicals by about 12-18 months (the usual time it takes for publishers to issue collected editions of recent storylines), so those numbers are likely to be even worse when 2019 data is tabulated. Superhero-adjacent genres like horror and science fiction also saw a slump in trade sales with the declining popularity of longtime best-seller The Walking Dead and the breakout series Saga on a publishing hiatus.

Meanwhile, sales of Asian-style manga – already one of the decade’s fastest-growing content categories – have benefited from the availability of animated series on streaming networks like Hulu and Netflix. Another presenter at the conference, NPD Executive Director of Business Development Kristen McLean, shared data showing a clear correlation between binge-watching of popular anime series and subsequent purchase of related manga content.

When you put all that together, it paints a stark picture. Superheroes represent a declining share of the fastest-growing segments and channels of the comics market. They still dominate in single-issue sales in comic shops, but both single issues as a format and comic shops as a channel represent a much smaller and shrinking share of the overall market than has been the case in years’ past.

Disney and AT&T are probably not losing too much sleep over this. The worldwide box office of a single, average-grossing superhero blockbuster feature is as large as the entire comics publishing industry, and the profits on mega-hits like Avengers: Endgame or Joker can buy and sell the entire book and periodical market several times over. Genre comic creators will see a bigger paycheck from an unexercised media option than they will from a best-selling comic book, and most artists on popular titles can earn more on commissions and sales of originals than they’ll get in royalties from reprints and trade collections.

Nevertheless, superheroes have been the dominant genre in American comics since the 1960s and are still the first thing a lot of people think of when they think of comics. Now that’s changing, the culmination of a decade-long market trend and a demographic shift in the audience for graphic literature. The change may not be obvious in the media culture for a while, but it’s coming soon to a bookshelf near you.

-M

. And yes, in Europe we have superhero comics, but it's just one the the various genres which we can choose. Superhero comics aren't a bad thing per se, but how they totally monopolized the American comics market. For you the Superhero comics are the default. The rest are the exception. And everyone one is astonished when not-superheroes comics (like Walking Dead or Saga) are successful.

. And yes, in Europe we have superhero comics, but it's just one the the various genres which we can choose. Superhero comics aren't a bad thing per se, but how they totally monopolized the American comics market. For you the Superhero comics are the default. The rest are the exception. And everyone one is astonished when not-superheroes comics (like Walking Dead or Saga) are successful.